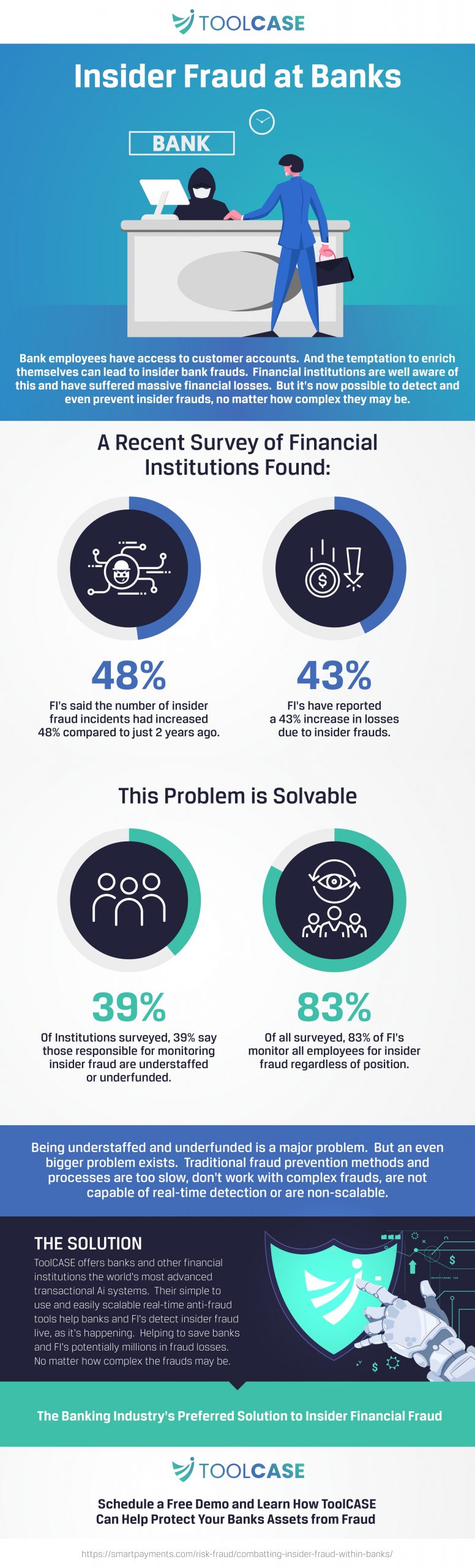

Insider Fraud at Banks

Bank employees have access to customer accounts. And the temptation to enrich themselves can lead to insider bank frauds. Financial institutions are well aware of this and have suffered massive financial losses. But it’s now possible to detect and even prevent insider frauds, no matter how complex they may be.

A recent survey of financial institutions found:

48% FI’s said the number of insider fraud incidents had increased 48% compared to just 2 years ago.

43% FI’s have reported a 43% increase in losses due to insider frauds.

This Problem is Solvable:

39% Of Institutions surveyed, 39% ay those responsible for monitoring insider fraud are understaffed or underfunded.

83% Of all surveyed, 83% of FI’s monitor all employees for insider fraud regardless of position.

Being understaffed and underfunded is a major problem. But an even bigger problem exists. Traditional fraud prevention methods and processes are too slow, don’t work with complex frauds, are not capable of real-time detection or are non-scalable.

Source: https://smartpayments.com/risk-fraud/combatting-insider-fraud-within-banks/

The Solution

ToolCASE offers banks and other financial institutions the world’s most advanced transactional Ai systems. Their simple to use and easily scalable real-time anti-fraud tools help banks and FI’s detect insider fraud live, as it’s happening. Helping to save banks and FI’s potentially millions in fraud losses. No matter how complex the frauds may be.